Solving the $1.7 Trillion Student Loan Problem

We partnered with Summer to launch a first ever student loan debt relief product on Credit Karma. The product helped our members become financially literate about their student loans, seamlessly connected eligible members to Income-Driven Repayment Plans (IDR), Public Service Loan Forgiveness (PSLF), and other forms of debt relief, and helped thousands of members save millions of dollars and move forward in their financial journey.

.jpg)

My role

⏵ Business case

⏵ Product strategy & roadmap

⏵ Product scope and requirements

⏵ Led Build Buy Partner exercise

⏵ Managed partner conversations

⏵ Led team on all phases of execution

⏵ Led go-to-market and scaling

Core team

⏵ 6 frontend/backend engineers

⏵ 2 designers

⏵ 1 product analyst

⏵ 1 growth marketer

⏵ 1 product legal counsel

Delivery

⏵ 2 months early experimentation

⏵ 6 months from inception to fully scaled

Problem

For our members: Student loan debt is an American crisis. We have $1.7 trillion in student loan debt across 43 million Americans. Aside from mortgage debt, it goes neck and neck with auto loans as the biggest debt in America. 22 million Credit Karma members represented more than half of this footprint, with millions defaulting on their payments due to a range of hardships. Our research had shown how student loan debt was preventing more and more Americans from moving on to other parts of their financial and life journey - buying a car to get to work, saving up for their first home, or even getting married and having kids.

For Credit Karma: Credit Karma's mission: Champion financial progress for all. And to this end, we profess to build tools for every step of your financial journey. Well, perhaps every step except student loans. We had an obligation to help our members in this area. Strategically we also had an opportunity to unlock this audience on Credit Karma - to increase customer engagement in a meaningful way, and to open up their access to valuable financial products.

We chose to invest in this problem because it was and is one of the largest debt problems in America, and because it was a significant problem for a very large percentage of our members. As far as a monetizable audience, millions of members with student loan debt faced depressed credit profiles, which in turn made them either ineligible or much less likely to be approved for many financial products. In addition, members were less likely to be engaged on Credit Karma, knowing that they were stuck, and choosing to avoid confronting their financial situation.

Solution

For the 22 million users on Credit Karma with federal student loans, we introduced the new Student Loans product through email and push notifications, in-app banners on the homepage, and highlighting their student loan tradelines on the Accounts page, nudging them to take action. Users could engage with interactive tools to improve financial literacy. More importantly, they could also complete an onboarding flow to provide a few details and opt into Credit Karma searching and applying for student loan debt relief programs on their behalf. Users could then monitor status and updates pertaining to their student loans, all on Credit Karma.

Solution Validation

Strategy

We decided to focus on the 93% of student loans that were federal, as opposed to the 7% that were private. This meant playing the long game in terms of prioritizing debt relief for our members, driving up sitewide engagement, and the retention and customer lifetime value of 22 million users. This, as opposed to the short-term monetization opportunity of 1.5 million users through refinancing private loans.

Strategic Approach

We took a layered approach to drive engagement and impact:

-

High-coverage low-friction features to help improve user awareness and education around student loans.

-

Personalized yet low-commitment interactive features that helped users simulate and visualize various scenarios with their student loan debt.

-

Higher-friction yet high impact onboarding process to get automatically connected to debt relief programs, and manage it all on Credit Karma.

Tactical Approach

-

Conducted user research, market analysis, and product analysis to gather customer insights.

-

Developed a business case with financial modeling, informed by customer insights and key stakeholder feedback.

-

Kicked off the initiative with a design sprint with cross-functional stakeholders.

-

Developed a roadmap with key milestones and metrics to hit for continued investment.

-

Ran experiments on small % of population in production to test hypotheses and hit goal metrics throughout the flow - from top-of-funnel engagement to conversion on debt relief applications.

-

Validated hypotheses and achievement of milestones drove decision to develop end-to-end student loans product on Credit Karma.

Success Metrics

-

Monthly Active Users: By introducing for the first time a product that addressed a problem for 22 million of our users, we aimed to drive a significant % lift in sitewide MAU. Not only did we create a new and compelling reason to visit Credit Karma, but for those who converted, they entered into a new engagement loop for a multi-year journey.

-

Application Conversion: We identified a large opportunity in terms of users we could successfully connect to debt relief. While we would also measure these specific metrics, it was a proxy to lower debt per user, lower payment default rates, improved credit profiles, and ultimately improved customer lifetime value.

-

$ Debt Reduction: The ultimate goal was to get our users out of debt as fast as possible. Whether through immediate debt relief or income driven repayment plans, we aimed to make an absolute impact on reducing student loan debt in America. We measured the average debt reduction per converted user, as well as the overall debt reduced through our product.

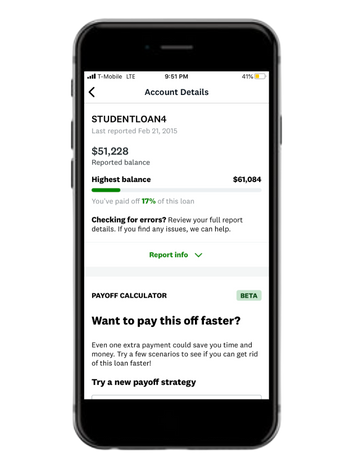

DEBT PAYOFF CALCULATOR

We built a debt calculator that worked flexibly across any type of debt the user had. In this case, we automatically pulled in the user's student loan data to help them understand the impact of different factors. The calculator helped drive user engagement and improved financial literacy by enabling users to visualize impact.

Impact

-

Launched embedded Student Loans product across Android, iOS, Desktop & Mobile Web

-

Scaled to all 22 million users with student loans (over half of borrowers in the US)

-

Drove 2% lift in sitewide MAU

-

In Year 1, wiped out $1 billion in debt across 100,000 users (avg of $10,000 per user)

Retrospective

Just as we were getting ready to scale, the COVID-19 pandemic hit, and this presented an unforeseen dilemma. We had invested a whole lot in building something to solve an important problem. We had confidence in the impact for both our members and Credit Karma... under normal circumstances. But early on in the pandemic, the federal government imposed a moratorium on student loan payments. On top of that, there were continued rumors and hopes that millions of student loans would magically be forgiven. Thus, we were concerned that users would not be compelled to take action. Admittedly, we initially delayed our go-to-market plans to time it with the lift on the moratorium. But because that continued to be a moving target, and because we were doing a disservice to our members the more we waited, we eventually rolled out our product even in the face of those uncertain times. We owed it to our members, and we're certainly happy that we did not wait any longer than we did.